Ultimately, we hope to provide you with the information you need to decide whether any no credit check loans in the UK that you may come across are the best choice for your finances. It is important to note that it is not easy to get a cash advance loan with a bad credit score the same day when you apply online. To have bad credit, you may have missed a payment in the past or defaulted on a loan entirely, for example, all of which influence your current credit score. No matter your reason for wanting to apply for instant payday loans, if you have a bad credit score and need a short term solution, a payday loan could be the solution for you. As responsible payday loan lenders, we follow FCA guidelines and carry out credit checks as part of your loan application. You can find more details on our Loans for bad credit and how you can still get the financial help you need with a low credit rating.

Having a low credit score can make it more difficult to be approved for credit, and this can cause people to look for payday loans from direct lenders with no credit check. However, offering payday loans with no credit checks in the UK goes against the guidelines of the Financial Conduct Authority . Some people worry about the rates due to the fact that companies are not getting involved in regular checks with traditional banks or loan companies. With direct lenders, there are no nasty surprises waiting around the corner when it comes time to pay back the money. Your lender will easily tell you what a monthly repayment will be, and this is it. There are cash advances that must be paid back within 14 days of when the funds are put into your checking account.

Payday loans in Water Valley, MS, are nice because you won't need to worry about what to do if something goes wrong. The payment amount must be approved before you are given any money, so there is no chance of ending up having to borrow more than you can handle. Borrowers often ask if they are guaranteed a loan, which is never 100% but Greenday's loans can assist borrowers when compared to a bank. When applying for our quick loans bad credit is not a concern. We specialize in offering the best online payday loans to people with poor credit scores. With our payday loans, bad credit scores won't lower your chances of getting approved.

Their short-term loans are available for with bad credit who would like to borrow. One of the most common types of bad credit loans is guarantor loans, also called guaranteed loans. This is when someone, usually a relative or close friend agrees to take the responsibility of paying your loan back if you can't. But don't worry, if you're looking for high acceptance payday loans direct lenders no guarantor, there are plenty of lenders offering bad credit payday loans that need no guarantor.

All payday loan lenders operate in a similar way and the process for obtaining a payday loan is basically the same for all of them. You will need to provide your chosen lender with personal and financial information, and request a certain amount of cash. If you are eligible for a payday loan and your application is approved, the money is deposited into your account the same day. The interest rates are usually high due to the convenience of these loans and the APR will depend on how much you are borrowing and for how long.

At the end of the loan term, the lender will take the repayment in full directly from your bank account. Personal loans and installment loans will require you to undergo stressful credit checks before being approved for the money that you need. With no credit checks, bad credit will not be a problem as long as you can provide proof of income.

Water Valley direct lenders will ask for your social security number to run a check for this, but once that is done, they focus on verifying how much you make. If you have to borrow money, it is important to be truthful about what you make. You have been working in your business or job for many years now, and they can see this with online pay stubs. This is information that they will check before deciding how much money you can borrow.

Multiple lenders only require borrowers to have a bank account and a minimum monthly income. Some lenders perform a soft credit check with the three major credit bureaus to review borrowers' credit history to determine a person's creditworthiness. However, having a bad credit score doesn't necessarily mean you cannot receive a payday loan. In accordance with FCA regulations, payday loans with no credit check from direct lenders are not permissible. For this type of loan, the lender would need to gather a sufficient amount of information to determine whether you would be able to afford the repayments. This should include performing a hard search on your credit record to ensure you are capable of managing your finances.

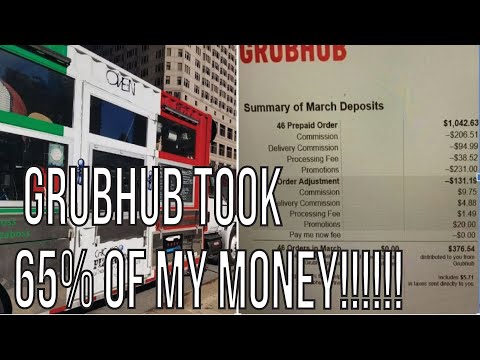

Even loans that advertise as affordable loans will need to have some sort of check on your credit rating, despite not being completely based on your score. If you need an alternative, you could try guarantor loans, credit cards, or personal borrowing. Choosing short term loans with no credit check involves the risk of being charged higher interest rates, default fees and charges. The risk may not be worth it, especially when there is a wealth of alternatives to payday loans from direct lenders with no credit checks available. Predatory online lenders are a serious problem, which is why we took the time to uncover the best online payday lenders for a short-term loan. Interests rates are usually higher for bad-credit borrowers than for people with a decent or excellent credit history.

When you're applying for a payday loan, it usually means you need cash in a hurry, often for emergencies. As payday loans direct lenders, we are able to offer you a fast, secure and easy process which ensures money is in your account as quickly as possible. Unlike traditional payday loans, you don't have to pay your full loan amount back on your payday; you can spread the payments out over 6 months to suit your own requirements. We trust you to make your repayments on time and it is important to us that you can trust us to be there for you when you need quick access to extra cash.

Customers who use payday lenders are often unhappy about the unpredictability of the lending decisions. They can be approved once, repay on time but then can't borrow again even though nothing has changed. At Polar Credit we give you an alternative to payday loans that you can rely on. As long as you budget responsibly and make your agreed repayments in a timely manner we are always here for you so you can borrow up to your credit limit whenever you need to.

What if you require immediate cash but do not qualify for a credit card? There may be other options available for borrowers, but payday loans would be at the top of our list. Most payday lenders can get cash deposited to your bank account within hours. Additionally, you do not need to have a good credit score to apply for this type of loan. Payday loan lenders use a variety of factors to decide the amount of credit a customer is able to borrow, including their ability to make the repayment. The application process for a payday loan is simple and fast, with an instant approval decision and funds released immediately, or within 24 hours depending on the lender.

If you decide to go ahead with the loan, the lender will perform a full credit search before releasing the funds. Without the proper checks carried out following FCA guidelines, no credit check loans from direct lenders present a serious risk to your finances. Creditworthiness and affordability checks are designed to protect you against financial difficulties. Any company offering short term or payday loans with no credit check is unlikely to have your best interests in mind. Yes, you can get a no credit check loan in Water Valley, MS when you apply online. This is because interest rates will be based on your income and employment status rather than how long you have had a bank account.

Many people who apply for payday loans online do so because they have bad credit scores. These borrowers might not meet the minimum credit score required to receive a loan from a bank or other financial institution. The main differences between a bank loan and an online payday loan are the speed and ease of access.

When you apply for a loan from a bank, you usually have to go through a somewhat complicated process, including meetings, paperwork and a long wait. Online payday loans from a direct lender are very different in this regard. Cashfloat's entire loan application process is purely online, and the form only takes a couple of minutes to fill out. You will then receive an instant online decision, and if approved, we'll send the money within one hour. There are many points to consider when looking to decide which lenders offer the best short-term loans for bad credit.

From the lender's reputation and the APRs they offer to whether they charge any additional fees, you must take everything into account before making your decision. To find the best poor credit payday loans for you, you then need to compare what the bad credit direct lenders are offering and compare this to your own needs. If you need a small loan to cover an unexpected bill, but your salary is just out of reach, you're in the right place! We're a payday loans direct lender, and we've been lending since 2014. With our fast loans, you can get money into your bank account today and pay it back within up to 6 months.

Cashfloat are a responsible direct lender of payday loans who have helped over 100,000 happy customers. They focus on customers with a previous bad credit score looking to improve, and making sure it's affordable for the customer. They also have a state-of-the-art 'Money on Demand' app so customers can manage their money and repayments on the go.

Under FCA guidelines, all loans providers should conduct some form of check on a borrower's credit score, even if they offer loans for affordability. This means that lenders should not be claiming to provide no credit check loans in the UK. Lenders should perform sufficient checks to ensure that you can comfortably make the repayments each month. If they do not check, there could be a chance that you cannot afford the repayments, leaving you in further financial difficulties. If you are looking for a way to secure the money you need, you could try a credit card or guarantor loan instead.

The guaranteed loans are the loans that are being provided by many companies in Water Valley, MS online. When you apply for loans online, your lender will explain the terms and conditions to follow. If you pay on time, you will be guaranteed a successful loan that lets you borrow more money.

You can apply for a cash advance loan in Water Valley, Mississippi through direct payday loan lenders whenever you need it. You need to pick a lender in Water Valley, MS who comes across as trustworthy and one who will explain the interest rates and fees upfront. The more transparent they are about what they charge, the less likely you are to be overcharged when your bill comes due. Be wary of lenders in Water Valley that ask for upfront costs such as credit checks or appraisals, and be on the lookout if they ask for reasons why you need the money also.

Once we have proof of the above, we will process your application as quickly as possible to provide a decision. Our application process includes a full credit check in which we will review your personal and financial information as well as your credit score. We will review your application based on your ability to pay and determine whether the payday loan you have applied for is suitable for you.

If all goes well, we'll give you a decision in minutes and transfer the agreed funds into your bank account the same day where possible. If after 3 pm or on a weekend, this will be the next working day. With our instant payday loans, you can borrow up to £1500 using your mobile phone, tablet, or computer, from the comfort of your home or anywhere with an internet connection. Our quick online application form takes just a few minutes to complete, and you'll get an instant decision .

As LoanPig is a direct lender of payday loans in the UK and a broker, you are in the best place to get the loan you need, even if you have bad credit. Let us help you, like the thousands we have helped before, find the amount and terms you can afford and get approved today. If you need cash fast to cover an unexpected bill or other financial emergency, payday loans through LoanPig can quickly help you resolve your situation. However, online lenders usually request permission from the borrower to withdraw the funds from their bank account, according to the loan term. Before taking out payday loans from lenders online, be sure to understand interest rates and fees. Every loan offer from an online lending marketplace will include fees.

If you're not careful about your payday loan amounts and monthly income, the cash advance could negatively impact your budget. A high acceptance payday loan is a type of payday loan that has a high approval rate compared to other loan types and even compared to other payday loans. Lending Stream started out in 2008, providing short-term loans for a 6 month repayment period. Their customers are from all around the UK and the average age is 32. However, they don't provide payday loans as they feel if the loan can't be paid back on payday, then the customer could be in worse debt.

They use a mix of reviewing individual cases, powerful data analytics and precious credit scores to approve loan applications. Payday loans are often used in situations where cash is needed to account for a financial shortfall. They are classified as a short term credit solution because they are normally provided for a short period of time, such as until your next payday. When it comes to payday loans and short term loans with no credit checks, the rules are clear.

Payday loans from direct lenders with no credit check other than a 'soft search' would not be permissible under FCA guidelines. We have many lenders that focus on providing poor credit personal loans. Applying for a poor credit loan with New Horizons will not harm your credit score. Because lenders initially only perform a soft credit check, which leaves no mark on your credit report.

However, it's essential to make all the repayments as agreed on any loan you accept, or it can damage your credit rating and affect your ability to get credit in the future. You can take a personal loan to cater for emergency cash needs. Personal loans are ideal alternatives when you want more than £1,000 or a longer repayment term such as 6 months or more. Personal loans have stricter qualification criteria compared to payday loans. Unlike payday loans, you can't get a personal loan if you have bad credit and if you're lucky, you will pay a high-interest rate.

You may also be required to get someone to cosign against your loan. Bad Credit Loans is another free platform that offers online loans, not providing these loans itself but instead connecting borrowers to the appropriate lender. And if the site does not manage to find the right match for you, it can refer to other lenders who can meet your lending criteria. As the name indicates, its main purpose is providing loans with affordable rates for people with bad credit history. But that doesn't mean that the page is tied only with obtaining bad credit loans.

Apart from connecting people to their right financial destination, Bad Credit Loans takes place in humanitarian and charity events. The application has a pretty easy form, providing you the chance to apply instantly in about five minutes. Just wait a few minutes, and your match will try to settle a deal along with your criteria. Money Mutual links customers only with a suitable lender and tries to keep your application preferences on the top shelf, in coordination with getting your loan in a record time. You are not restricted on what loans you can apply for, so therefore, you can apply for payday loans, installments, and even bad credit loans.

With the help of internet lending marketplaces, you may quickly remedy financial difficulties. Emergency loans are a good alternative if you need money fast and have a bad credit score. Many lenders, especially online platforms, can provide you with the cash you need in only a few days. If you need an emergency loan, bear in mind that you will have to pay it back at a specific time slot. Money lending websites such as MoneyMutual may assist those with bad credit by offering emergency loans. MoneyMutual is one of the most well-known emergency lending networks.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.